work opportunity tax credit questionnaire reddit

The WOTC is a non refundable tax credit that can be carried back up to one year or carried forward up to 20 years. It is a Work Opportunity Tax Credit.

Application Process Amerisourcebergen

Its asking for social security numbers and all.

. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. The very first question is Are you under age 40 How is this legal. WOTC Improve Your Chances of Being Hired.

I kinda feel like its unfair that they. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. This tax credit program has been extended until December 31 2025.

Essentially employers will get tax credits if they higher employees from specific groups. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. In general understanding tax credits can make a huge difference in whether you owe money come tax season or get a larger return. The Work Opportunity Tax Credit WOTC can help you get a job.

Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for. What is the Work Opportunity Tax Credit Questionnaire. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are based on age. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. Employers must apply for and receive a certification verifying the new hire is a.

For example if an employer hires someone who graduated from college in the past two years they will get a tax credit. This tax credit may give the employer the incentive to hire you for the job. I dont feel safe to provide any of those information when Im just an applicant from US.

WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment. I feel like Im not getting a call back to any of these companies I apply for that ask the WOTC questions. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

As part of the application process we ask that you complete a short questionnaire in order to assess eligibility for the Work Opportunity Tax Credit Program WOTC. The answers are not supposed to give preference to applicants. Below you will find the steps to complete the WOTC both ways.

Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. The employee groups are those that have had significant barriers to employment.

There is a cap on the amount of WOTC-eligible wages per qualified employee. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. It also says that the employer is encouraged to hire individuals who are facing barriers to employment.

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

A couple of jobs I have applied for have required me to complete the Work Opportunity Tax Credit as part of my application process. Thats a lot of money compared to the short amount of time it takes to screen new hires. There are two sets of frequently asked questions for WOTC customers.

Optimizing on these opportunities will depend. Work Opportunity Tax Credit. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that.

Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. This varies by group although most groups have a cap of 6000 so employers can claim at most a 2400 tax credit for each employees first year.

The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. The Work Opportunity Tax Credit or WOTC is a general business credit provided under section 51 of the Internal Revenue Code Code that is jointly administered by the Internal Revenue Service IRS and the Department of Labor DOL. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them.

This tax credit is for a period of six months but it can be for up to 40 percent if the employer conducts job training. Completing Your WOTC Questionnaire. Get answers to your biggest company questions on Indeed.

It asks for your SSN and if you are under 40. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. The federal government uses the tax credits to incentivize employers to hire from specific groups.

At the low end of the scale a WOTC-certified new hire working at least 120 hours in the year could qualify you as the employer to claim 25 of the first years wages for a tax credit of as much as 1500. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. The WOTC is available for wages paid to certain individuals who begin work on or before December 31 2025.

Lately when I am applying for jobs many companies have me me fill out this application for WOTC so the company can see if they can get a tax break if they hire me. Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits.

This questionnaire will not. Questions and answers about the Work Opportunity Tax Credit program. The Work Opportunity Tax Credit WOTC is a federal tax credit that can be significant for many employers but many may not know how it works or can impact their financials.

Changes Under The Consolidated Appropriations Act Grant Thornton

Managing Your Flight Department Like A Business Nbaa National Business Aviation Association

Nbaa Backed Saf Blenders Tax Credit Advances In House Of Representatives Nbaa National Business Aviation Association

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Re Evaluating Work And Retirement Franklin Templeton Commentaries Advisor Perspectives

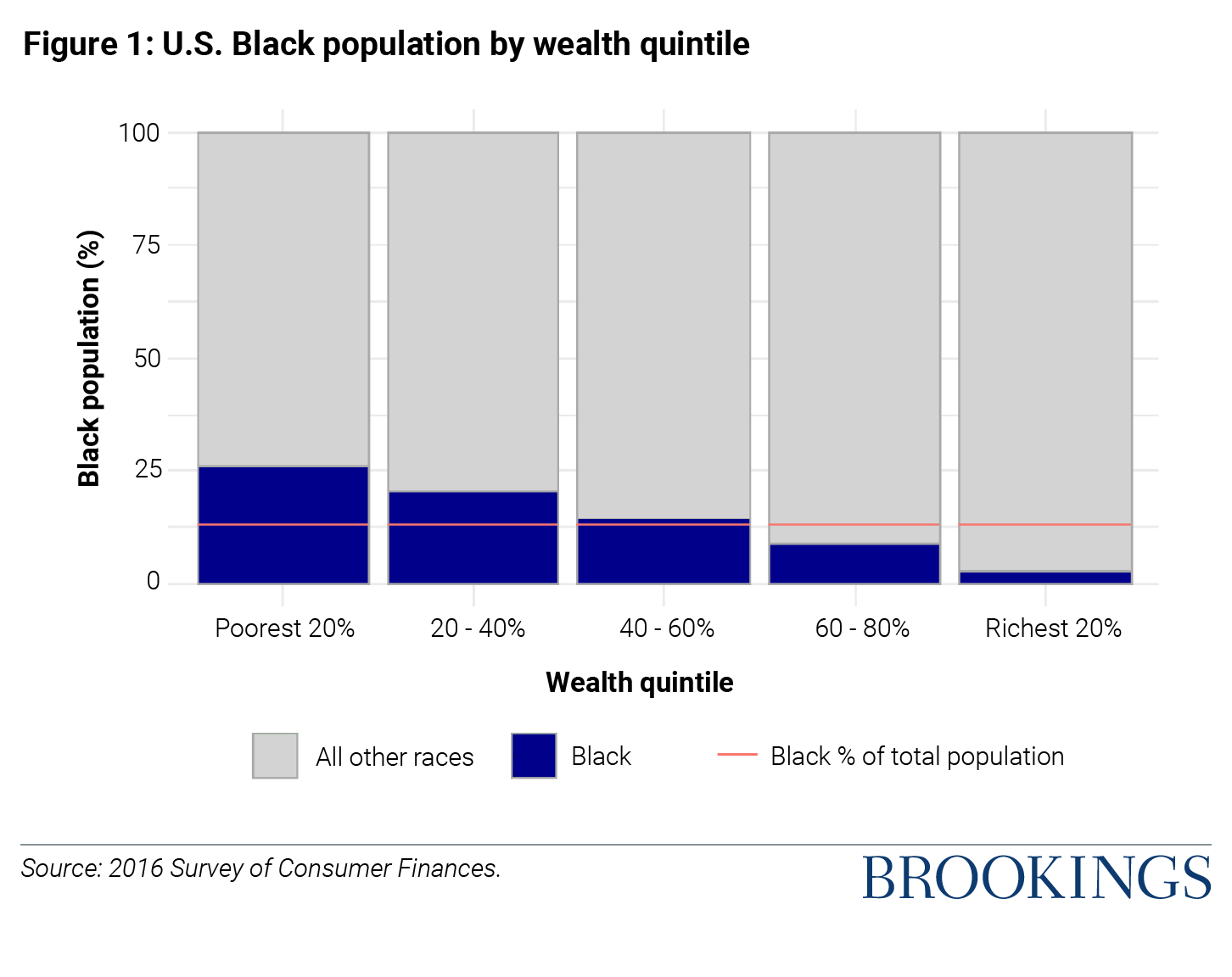

Closing The Racial Wealth Gap Requires Heavy Progressive Taxation Of Wealth

Walmart Distribution Center Hiring Event Calendar Port St Lucie

/cdn.vox-cdn.com/uploads/chorus_image/image/70074282/GettyImages_1234979685.0.jpg)

Why Biden S Build Back Better Plan Doesn T Include Free Community College Vox

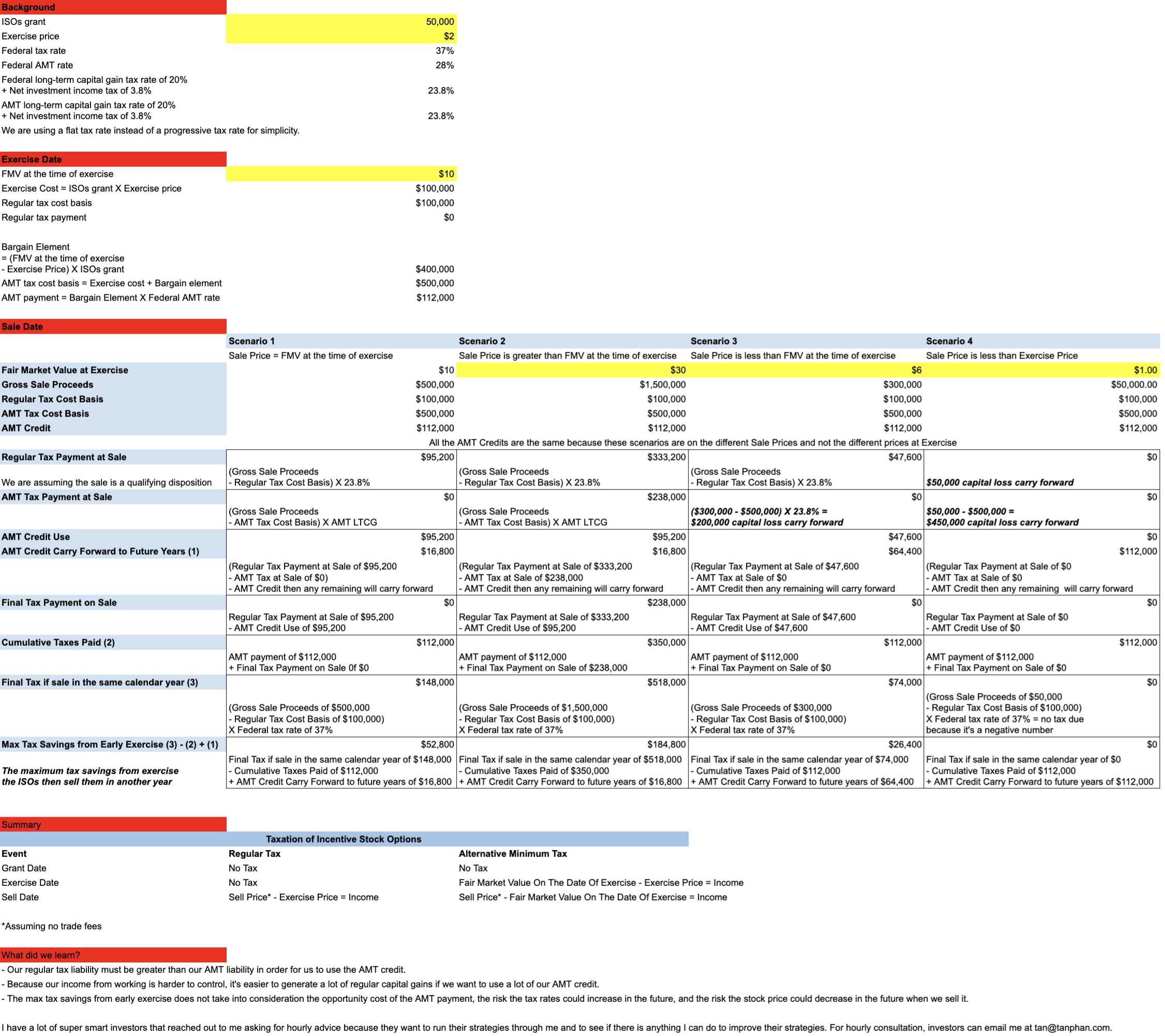

Alternative Minimum Tax Amt Credit Examples Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Alternative Minimum Tax Amt Credit Examples Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Mrpa News Maryland Resource Parent Association

Wotc Questions How Do I Fill Out The Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1144541711-111b0ab2182848498ec783fa6d5bbd35-b749d033009a41a2903348e46f7bde60.jpg)

How Does The Work Opportunity Tax Credit Work

What Is The Great Reset And How Has Russia And Ukraine Changed It Opinion Deseret News

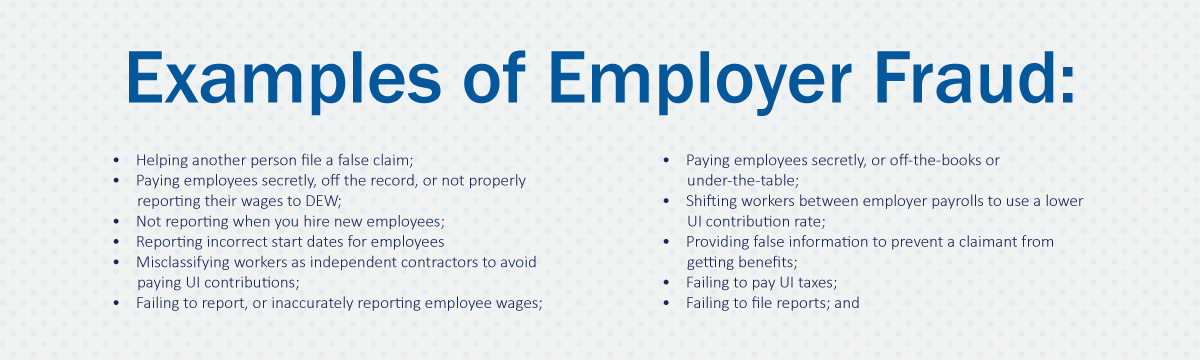

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Central City Economic Development Cced Sales Tax District Kcmo Gov City Of Kansas City Mo

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Central City Economic Development Cced Sales Tax District Kcmo Gov City Of Kansas City Mo